Published on

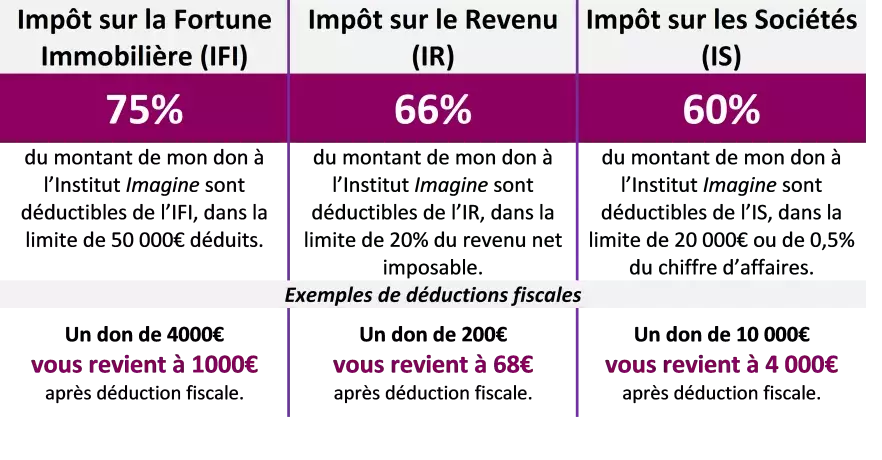

A large number of countries encourage philanthropy through tax incentives in order to promote generosity to the associations and foundations that are important to them. France remains one of the countries where the tax system is the most incentive by favoring three fields: the reduction of income tax (IR), corporate tax (IS) and the tax on real estate wealth (IFI).

The best known of the schemes concerns income tax (IR), allowing a reduction of 66% of the amount of your donation up to a limit of 20% of taxable income per year[1].

But another scheme allows people subject to the tax on real estate wealth (IFI) to access a reduction of 75% of the amount paid.

How does this tax work and how can it play a positive societal role in supporting medical research?

Since 2018, the real estate wealth tax (IFI) has replaced the wealth tax (ISF). Your tax household is liable for the IFI if your net taxable real estate values[2] are valued at more than €1.3 million on January 1, 2021.

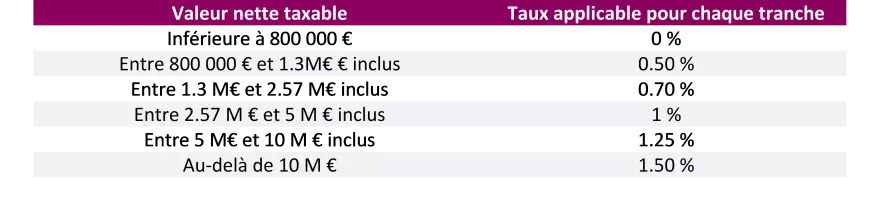

The calculation of this singular tax is obtained by applying a scale composed of 6 evolving brackets.

On the other hand, even if the threshold to be liable for the IFI is set at €1.3M, the first bracket for the calculation of the tax starts from €800,000 of net taxable property value, as follows

NB : if the net taxable value is between 1.3M € and 1.4M €, a discount is applied equivalent to 17 500 € - 1.25 % *net taxable value

For example :

-

Your net taxable real estate assets amount to 1.35M€, your taxation under the IFI is calculated as follows IFI = (1.35M - 1.3M) * 0.70% + (1.3 M - 800k) * 0.50% - discount, where discount = 17,500 - 1.25% * 1.35 M € =625€, i.e. IFI = 2,225

Your net taxable real estate assets amount to €1.5M, your taxation under the IFI is calculated as follows: IFI = (1.5M - 1.3M) * 0.70% + (1.3 M - 800k) * 0.50% = €3,900 (no discount).

If you are subject to the IFI, by making a donation to Imagine, 75% of the amount of your donation is deductible from the IFI due. This reduction is limited to an amount of 50 000 € (equivalent to a donation of 66 667 €).

Examples :

NB: Calculations made from the rate in effect in the first quarter of 2021. 5200€ * 0,75 = 3900 €.

Dates and modalities:

- The IFI return is to be filed as an appendix to your 2042 income tax form and must be filed at the same time and within the same deadlines as your income tax return.

- If you file your tax return on paper, it must be filed no later than May 20, 2021.

- The deadline for filing online, which has been mandatory since 2019 (except for people who do not have internet access or do not know how to use it), depends on where you live:

- May 26 for departments 1 to 19 and residents abroad ;

- June 1st for departments 20 to 54 ;

- June 8 for departments 55 to 95 and DOM-TOM.

- In order to be deducted from your IFI, your donation must be received before the deadline for filing your income tax return.

- Your tax receipt is not necessary to complete your return. It will only be requested in case of a tax audit.

By donating to Imagine, you enable our researchers to accelerate research for the benefit of children and families affected by genetic diseases. And you benefit from an attractive tax reduction.

If you have any questions about the IFI, please contact Laurent Mellier, Director of Development and International Philanthropy at the Imagine Institute

laurent.mellier@institutimagine.org

As a reminder:

Please note:

It is possible to split your donation to deduct part of it from the IFI and another part from the income tax/IRPP (it is of course not possible to cumulate the IRPP and IFI reduction on the same donation bracket). It is then simpler to make two separate donations in order to receive two separate tax receipts and deduct one of the donations for the IFI and the other for the IRPP.

[1] For payments made to associations that help people in difficulty, the reduction rate is increased to 75% up to a limit of 1,000 euros.

[2] The sum of the elements linked to the real estate assets held directly and indirectly (e.g.: main residence, houses, parking lots, cellars, undeveloped land, shares or stocks in real estate companies, mutual funds and SCPIs, etc.) must be established and the related debts deducted. Note that your main residence is subject to a 30% deduction on its value as of January 1, 2021. Do not hesitate to contact us if you need more details concerning the list of real estate assets included in the tax base for the calculation of the IFI and for the calculation of your IFI.